No issue which edition of the software program you make use of, Quicken provides a helpful format for monitoring real estate investments like as income home. By making use of the Quicken software program for this récordkeeping, you can prepare summaries of revenue and expenses by home for supervising your individual real property opportunities. You can also easily full the Routine E revenue tax type you use (or create it less complicated for your taxes accountant to get ready your Plan E taxes type). Moreover, if you fixed up resource balances for each of the specific real estate properties you hold and after that use these to record both capital enhancements and any depreciation, you can effortlessly calculate any gains or deficits coming from the purchase of a item of true property. This brief discussion, as a result, explains the basics of how you do this in any edition of the Quicken software program. Nevertheless, an important take note: If you have the budget and can use the Quicken Local rental Property Manager plan (the nearly all expensive edition of Quicken), you don't want to follow the guidelines given right here. You can basically use the Local rental Property Supervisor's wizards to step you through the procedure.

Describing Your True Property Holdings To track revenue and expense by personal real property real estate, you need to perform two things:. Set up the income and expenditure categories required to describe this earnings and cost. You should use the exact same income and cost classes that show on your Schedule E taxes form. Fixed up a class for each personal real property real estate, and after that, whenever you rank an revenue or expenditure product for a particular property, recognize the home by supplying the course.

I'm sorry I don't have any personal experience with the Rental property management features, I've looked in the knowledge base for articles which mention rent reminders and have added them below. Hopefully another user with rental experience chimes in. Jun 26, 2018 E-mail Reminders — With Home, Business & Rental Property, notify tenants of rent due and send payment receipts. Features Introduced in Quicken 2017 Improved Mobile App — A more powerful mobile app, now with investment tracking (excludes Starter Edition), offline use.

(Take note that if you possess just a one real property expense and you know for certain that you'll never ever add another genuine estate expense to your collection, you wear't want to arranged up courses.) Both jobs are referred to in the paragraphs that follow. Placing Up Classes for Real Estate Ventures Based on what you told Quicken when you installed it, Quicken may currently possess the classes you require on its group list. However, if Quicken doesn'testosterone levels already have the classes you require, you effortlessly add them. To arranged up types for tracking the earnings and reductions related to your true estate ventures, start Quicken and adhere to these steps:. Choose the Lists → Type List order to display the Class List screen. Click on the Add Category order key to display the Place Up Group dialog container. Make use of the Group Name text message box to provide a brief title for income or deductions product.

For example, if you're establishing up a category to monitor a real estate supervisor's expenditure, you might make use of the group name “Manager.”. Use the Revenue or Expenditure option button to mark the new group as one that tracks either earnings or cost. If you require to describe the class in additional detail, make use of the elective Description text package. Quicken adds the new group to the checklist shown in the Classification List window. Repeat ways 2 through 6 for each earnings or expenditure category you'll use. Placing Up Courses for Real Estate Purchases To established up courses for your actual estate ventures, begin Quicken and stick to these actions:. Select the Lists → Course order to display the Course List windows.

Click the New control key to display the Place Up Course dialog package. Use the Name text container to offer a short title for the true estate home. For illustration, if you're establishing up a class for a rental house and the home offers the name “Winston Flats,” you might cut short this to “Winstón.”. If you need to describe the real estate in even more detail, like as noting the street address, make use of the Explanation text package. Quicken provides the new course to the list demonstrated in the Course List windowpane. Repeat actions 2 through 5 for each true estate property or home you'll monitor as an expense using Quicken. Setting up Up Subclasses for True Estate Purchases You might furthermore need to fixed up subclasses, which are usually simply classes utilized to classify the components of a class, for your actual estate assets.

For illustration, if you established up a class for Winston Flats but desire to separately track revenue and costs related to a particular kind of tenant, such as low-incomé tenants, you couId generate two subclasses: “Qualified,” for tenants who qualify as low-incomé tenants, and “NonquaIified,” for tenants whó put on't qualify. (You might need to do this, for example, if you're also claiming federal government low-income housing credits for a property or home and thus need to track tenants by class, too.) To set up a subclass, you get the exact same measures you make use of to fixed up a class. Keep in brain, however, that you can use only 31 characters to get into categories, subcategories, classes, and subclasses. All this information will go into the Category combo container, so use brief names. For example, suppose you rent some flats to skilled low income tenants in order to meet up with either local or federal requirements. In this situation, you might use “Qual” and “Nónq” for Qualified ánd Nonqualified. Warning: Quicken allows you use subclasses and classes interchangeably.

You can make use of a class as a subcIass and a subcIass as a course. Therefore, if you do select to make use of subclasses, you require to be more cautious in your data entry. Monitoring Earnings and Costs by Property or home As soon as you've arranged up lessons for each of your specific properties, you're ready to start tracking revenue and expenditures by property.

To do this, simply get into both the revenue or expense class and the class name in the Category text container, isolating the classification from the class with a slash. To report a rent check from one óf your Winston Flats tenants when “Rental Income” will be the income type and “Winston” is the course name, for illustration, kind “Rental Income/Winstón” in the Class combo container. If you've utilized subclasses, such as “Qual” ánd “Nonq” to identify tenants as experienced and nonqualified (Iow-income) tenants, adhere to the class title with a colon and after that the subclass title. To document a lease check from one óf your Winston Apartment “qualified” tenants when “Rental Income” can be the revenue classification and “Winston” will be the class name, for instance, kind “Rental Income/Winstón:Qual” in thé Class combo container.

Courses can become a little complicated for a few of factors. You can fIip-flop the courses and subclasses because Quicken doesn't monitor your lessons and subclasses separately. From its viewpoint, they're both the exact same.

And you can't tell Quicken to generally remind you to enter a class, which you can perform for categories. So end up being careful to often use lessons and subclasses, ánd if you discover that a document displays unclassified quantities, use QuickZoom to find the unclassified dealings you require to repair. When you need to print out an income and expense survey by residence, create the Work/Project document, by choosing Reports → Business → Job/Project and after that clicking the Create key. Setting up Up Real Estate Investment decision Accounts You can make use of Quicken accounts to track the altered cost base of specific real property ventures. You calculate the get or loss upon selling by subtracting the modified cost time frame of a property from the net sales cost. To perform this, set up a Quicken asset accounts for individual real estate properties.

Download Hotspot Shield's Free VPN for mac to unblock websites and keep your identity protected. Download for FREE now. Hotspot shield download for windows 10. Hotspot Shield for Mac, free and safe download. Hotspot Shield latest version: Access blocked sites and encrypt your surfing.

Whenever you make an enhancement to the property, report the improvement as an raise in the property's balance. Usually, the best way to perform this is to simply rank the check you compose to spend for the improvement as a transfer to the home account.

You can furthermore document the regular depreciation you'll use for computations of the taxable income or loss on the actual estate expenditure. To do this, very first fixed up a devaluation expense group, like as “Depreciation.” Then report an yearly depreciation expense purchase that reduces the residence's account stability.

To report a depreciation on Winston Apartments when “Depreciation” is certainly the expense category and “Winston” is usually the course name, for example, kind “Depreciation/Winston” in the Category text package. If you're interested in studying even more about using Quicken, feel free to. Nelson is definitely the writer of more than two dozén best-selling textbooks, including Quicken for Dummies and QuickBooks for Idiot's. Nelson is definitely a licensed public accountant and a associate of both the Wa Community of CPAs and the Us Institute of CPAs.

He keeps a Bachelors of Technology in Accounting, Magna Sperm Laude, from Central Washington College or university and a Professionals in Company Administration in Finance from the University or college of Washington (where, strangely enough, he had been the youngest ever person to graduate student from the system). Readers Connections. I came on your Web posting by accident while looking for clews on how to manage amortized expenses within Quicken. My books on Quicken ánd everything I found on the Web attended to the amortization of loan products, but not capital expenses that must end up being distribute over several decades. After very much thought, I've found an approach that will function, but it is usually only one of several Quicken processes I've used over the years to assist in tracking earnings expenses associated with my rentaI properties. If yóu're interested, I'd end up being content to talk about them with yóu in the wish that another set of eye will improved them nevertheless further.

In specific, I've developed a procedure to manage payroll reductions that facilitates verification that money due to the federal government have been recently sent to the federal government. However, be warned that I'michael still making use of Quicken 2003, and it is certainly not because I'm too cheap to up-date. For the most part it is because I believe, ‘if is definitely ain't smashed, don't fix it.'

At different periods, I researched more up to date versions of Quicken and discovered them as well challenging; they was adamant on an Web link, and that I tolerate purchase pitches for various Intuit products. Probably the most recent edition of Quicken doesn'capital t have got those weaknesses, but a round with a personal information thief has eliminated any inspiration to enhance; to preclude give up of delicate details, my Quicken financial records now dwell on a personal computer without an Internet link. I wear't have got a firewall; I have got an air difference. But even more important, what I wear't have is certainly a fear that an unintentional starting of some criminal web web page could show to a nefarious individual that I'michael a beneficial focus on for thieves. Given that my processes all work on Quicken 2003, they'll undoubtedly function on the even more up-to-date versions. Allow me know what you think.

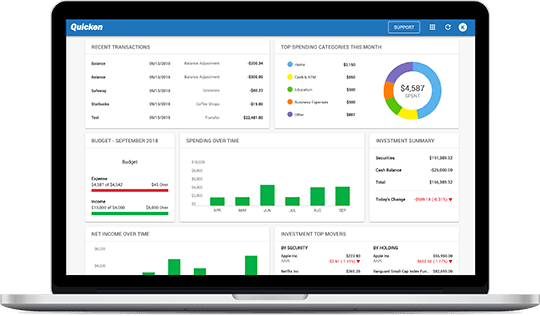

Quicken organizes your individual, business rental real estate funds all in one location. Safely imports your bank or investment company transactions. Categorizes your private and business expenses. Exhibits your income and reduction at a glance so you understand how your business is carrying out. Identifies tax-deductible company expenditures to increase tax deductions. Creates Plan C reviews to make easier taxes.

Organize and conserve your rental paperwork (contracts, leases, etc.) straight in Quicken. Create custom invoices with your logo, colours, and weblinks. Pay out your expenses in Quicken for free of charge with Quicken Expenses Pay. Limitless priority gain access to to public Quicken phone support.

Shipping Profits These are usually SoftwareCW's i9000 Standard Shipping Policies applicable only to products purchased by you straight from SoftwareCW. If you purchased several items to become delivered to the same address, we may send them to you in independent boxes to provide you the speediest assistance. Tracking is obtainable for all purchases. We ship to the United Says and Europe only. Please be sure to be conscious buyer is usually accountable for all traditions charges/taxes for global orders. These charges cannot be prepay and we have got no way of understanding how very much these charges will end up being.

You can contact your regional customs office for even more information. Also notice, we cannot indicate the bundle as 'Gift' and will declare the real order value on traditions forms.We make every work to ship your product as soon as feasible. However, some other factors such as confirmation of payment, your shipping area, may result in some orders to end up being delayed.

Remember that these quotes are for period in transit only, and that they perform not utilize until the product results in our services. As the shipping of your order is definitely beyond our handle once your order leaves our services, we cannot suppose liability for late deliveries, irrespective of the Delivery technique you state. Return Plan: These are SoftwareCW'beds Standard Return Policies appropriate just to items bought by you straight from SoftwareCW. All results must end up being received within 30 times of receipt of item or the return will end up being voided. Make sure you immediate all concerns after 30 times to the producer.

Recent Posts

Categories